Many of the special needs children have special abilities by which they earn income e.g. a child may be creating art masterpieces which are sold on various platforms, some child may be a pro in music & performs with some band and gets paid for the same, etc. Other than this, there may also be income earned from other sources e.g. income from bank interest, etc.

The word ‘Clubbing’ means to join or add. Accordingly, ‘Clubbing of Income’ means adding or including the income of another person (mostly family members) to one’s own income. This is according to Section 64 of the Income Tax Act, 1961.

First, let us take an overview of general clubbing provisions and then understand its applicability on the income earned by a special needs child.

Income Tax Act, 1961 contains provisions as to how the income earned by a child is to be accounted/reported for, whether such income is to be clubbed with the income of parent or not and how.

One important point to understand here is that clubbing provisions apply only to certain specified income of specified persons. Income earned by any/every person cannot be randomly clubbed while computing the total income of an individual. Clubbing provisions can be applied only in accordance with the relevant provisions.

In relation to the income earned by a specified person (in this blog we talk about only minor – special needs/NT/minor married daughter), below is the gist of the said provisions in a simplified manner.

| Clubbing of Income of Minor Child | |

| Applicable Section | Section 64(1A) of the Income Tax Act, 1961 |

| Specified person | Minor child |

| Specified scenario | – Any income arising or accruing to minor child – Child includes both step child and adopted child – Clubbing provisions also apply to minor married daughter |

Is Minor child’s income clubbed with the income of parent?

As per Section 64(1A)**, income of minor child is clubbed with the income of his/her parent.

Provisions

- Income will be clubbed in the hands of higher earning parent

- However, if the marriage of parents does not subsist, then the income of minor shall be clubbed in the hands of that parent who maintains the minor child in the Previous Year.

- Sec 10(32) – when the income of minor child is clubbed in the parent, then such parent is allowed an exemption of Rs 1,500/- or income of minor so clubbed, whichever is less

- Income earned by a minor child on account of manual work, by application of his skill, talent or specialized knowledge is not to be clubbed in the hands of parent. However, accretion from such income will be clubbed with the income of parent of such minor

** Provisions of Section 64(1A) are not applicable on the income of a minor child suffering from a disability specified under Section 80U.

Read more about Section 80U https://www.autismfinancialplanning.com/section-80u-income-tax-deduction-for-person-with-autism/

Hence, a minor who has any disability specified under Section 80U, his/her income will not be clubbed in the hands of parent.

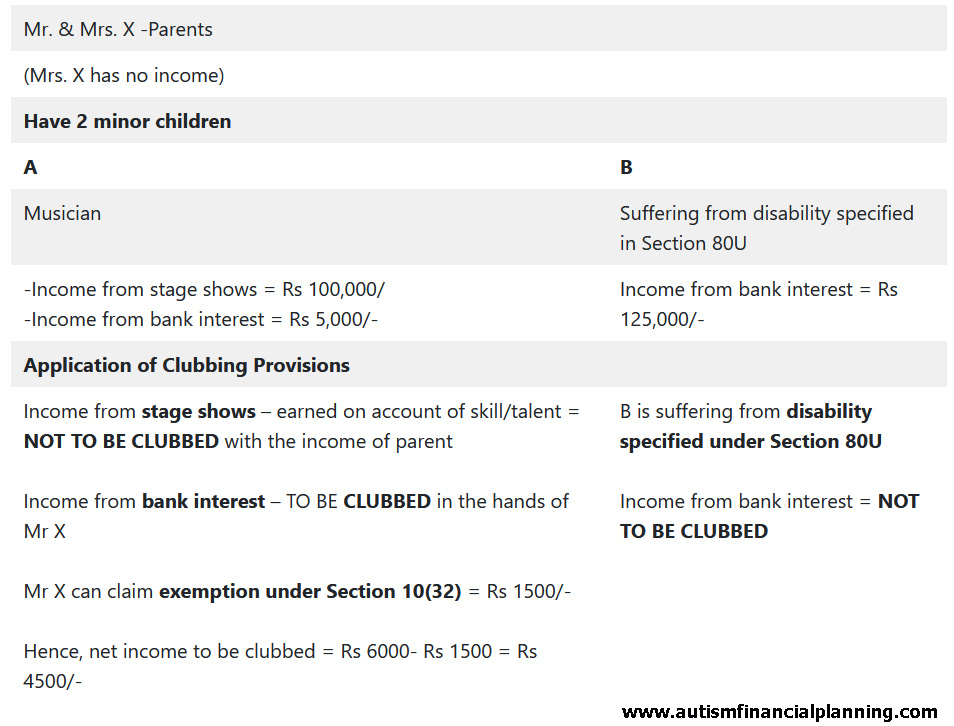

Illustration